Opportunities

Suitable for Eligible Wholesale Investors as defined by the Financial Markets Conduct Act 2013.

Currently the opportunities present themselves in three categories.

Property

Most of the selected property opportunities have an expected return of around 20% p.a. as a direct result of purchasing well, and only focusing on opportunities to add value, rather than relying on any natural market increase.

Software

The current Software offering is MyGroupDiscount (MGD), which is expected to be launched Nationally in 2025 and globally thereafter. We are currently working with the University of Otago regarding its marketing. Other software offerings will be announced as they mature.

Finance

Our finance offering is via ParkitCapital which is offering attractive monthly interest of 10% to 14% p.a. over 1 to 5 year terms. The funds raised are predominantly invested in secure Property investments.

Feel free to contact us anytime if you require further information.

Property

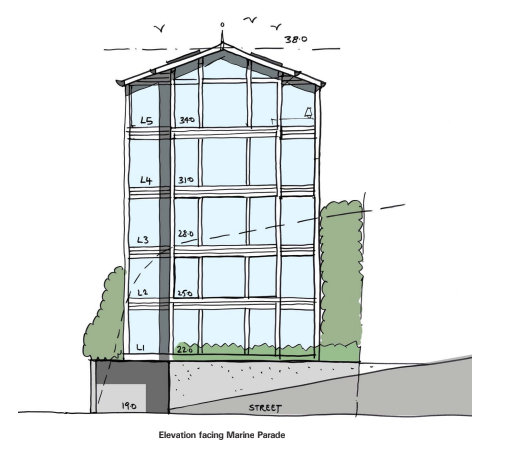

Marine Parade, Napier

20% (being 10% p.a. cash paid monthly and 10% p.a. projected capital growth)

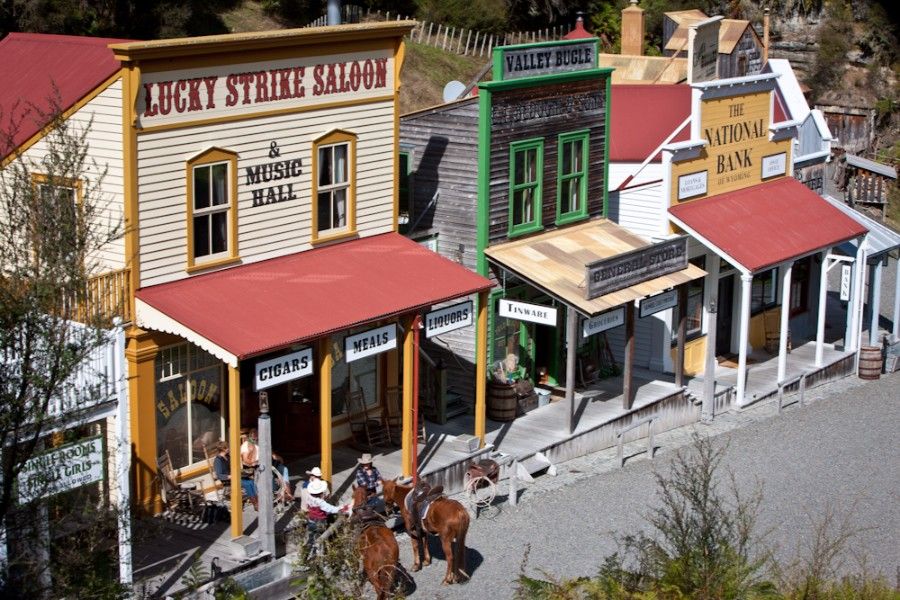

Treasure Island, Northland

20% (being 10% p.a. cash paid monthly and 10% p.a. projected capital growth)

Treasure Island, Northland

Shares and an Allocated Site.

Mellonsfolly Ranch

20% (being 10% p.a. cash paid monthly and 10% p.a. projected capital growth)

Office Tower, Wellington

21% (being 11% p.a. cash paid monthly and 10% p.a. projected capital growth)

An opportunity exists to securely invest in a well located, high-quality, earthquake strengthened, medium term tenanted, office tower in Wellington, New Zealand, with significant upside.

In simple terms:

Purchase Price: 41.3m (as per current valuation)

Costs: 1.2m

Cash in Bank: 2.5m

Total: 45m

Funded by:

First mortgage: 25m currently approved and in place

Investors: 20m (15m has been underwritten/allocated)

Total: 45m

Intention:

The intention is to add value to the lease profile, (and the building), take advantage of an expected positive yield shift (as interest rates decrease over the medium-longer term) and increase the value of the property to 55,000,000 (8% net yield based on current net income) within 3 years.

This will provide an expected a gross margin of 10,000,000 less costs of 4,000,000 = 6,000,000 being 30% return on 20m of investor funds over 3 years = 10% p.a. plus their 11% p.a. i.e. an overall return of 21% p.a.

Please initially advise us of your interest in ANY amount (from 100 to 20,000,000) by return email asap.

Regards

Paul Nicholson (advisor to www.nicholsongroup.nz)

Software

MyGroupDiscount

Finance

ParkitCapital

A fixed interest fund offering the following terms.

1 year 10% p.a.

2 year 11% p.a.

3 year 12% p.a.

4 year 13% p.a.

5 year 14% p.a.

Contact

We’d love to hear from you! Drop us a line below and we’ll do our best to get back to you within one business day.

For direct inquiries please call